It’s one of the first questions every new business owner asks: “Can I do my own bookkeeping, or do I need to hire someone?” It’s a fair question, especially when you’re watching every penny and trying to keep costs down in those crucial early months.

The short answer is yes! You absolutely can do your own bookkeeping. Thousands of business owners manage their books successfully without professional help. However, whether you should do it yourself is a different question entirely, depending on your skills, available time, business complexity, and the value of your time versus the cost of professional support.

This guide will help you make an informed decision by explaining what bookkeeping actually involves, assessing whether DIY is realistic for your situation, showing you how to do it properly if you choose to, and helping you recognize when it’s time to bring in professional help.

What Does Bookkeeping Actually Involve?

Before deciding if you can do your own bookkeeping, you need to understand what you’re committing to.

Core Bookkeeping Tasks

Recording income:

- Logging every sale, invoice, or payment received

- Categorizing income by type (sales, services, etc.)

- Tracking which customers owe you money (accounts receivable)

- Following up on overdue payments

Recording expenses:

- Logging every business purchase and payment

- Categorizing expenses correctly (supplies, travel, utilities, etc.)

- Capturing and storing receipts digitally or physically

- Tracking which suppliers you owe money (accounts payable)

Bank reconciliation:

- Matching your records to bank statements

- Identifying and investigating discrepancies

- Ensuring every transaction is accounted for

- Catching errors, fraudulent charges, or bank mistakes

Managing cash flow:

- Monitoring money coming in and going out

- Forecasting future cash positions

- Ensuring you have funds to pay bills and salaries

- Planning for tax payments

VAT record-keeping (if registered):

- Recording VAT on sales (output VAT)

- Recording VAT on purchases (input VAT)

- Maintaining proper VAT invoices

- Preparing quarterly VAT returns

Generating reports:

- Profit and loss statements

- Balance sheets

- Cash flow statements

- Management reports for decision-making

Time Commitment

How much time does bookkeeping take? It depends entirely on your business:

Very small business (sole trader, few transactions):

- 2-4 hours per month

- 30 minutes weekly if done regularly

Small business (moderate transactions):

- 4-8 hours per month

- 1-2 hours weekly

Medium business (high transaction volume):

- 10-20+ hours per month

- 2-5 hours weekly

Most business owners who “do their own bookkeeping” actually just stuff receipts in a drawer all year, then spend 20+ hours in January panic-mode trying to piece everything together. Regular, weekly bookkeeping is far less painful than annual catch-up.

When DIY Bookkeeping Makes Sense

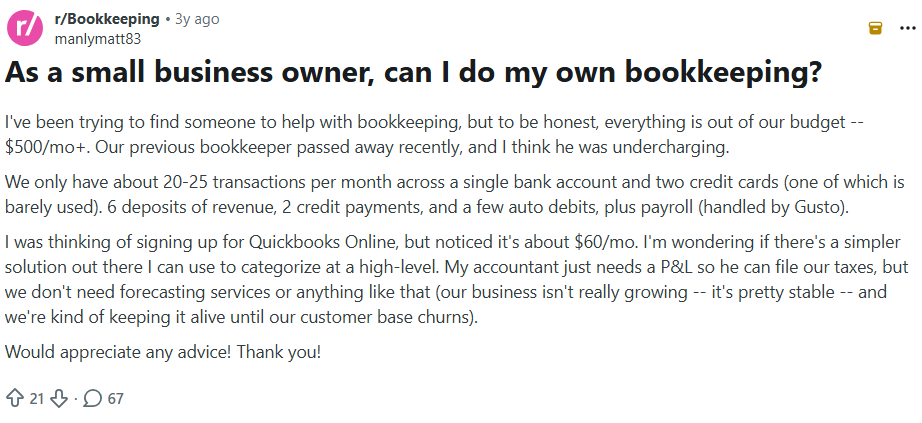

“You’re not the only one asking this.” A real question from a small business owner wondering whether DIY bookkeeping makes sense.

Doing your own bookkeeping can work well in certain situations.

You’re a Good Candidate for DIY If:

1. Your business is simple:

- Sole trader or very small limited company

- Low transaction volume (under 50 transactions per month)

- One bank account

- One income source

- Minimal expenses

- Not VAT registered (or simple VAT)

2. You’re comfortable with numbers:

- You don’t find financial tasks intimidating

- You’re organized and detail-oriented

- You can follow systems consistently

- You’re willing to learn bookkeeping basics

3. You have time available:

- You can dedicate 1-2 hours weekly to bookkeeping

- You won’t let it pile up for months

- You can maintain consistency

4. You’re using good software:

- Modern cloud accounting software (Xero, QuickBooks, FreeAgent)

- Automated bank feeds

- Mobile receipt capture

- User-friendly interface

5. Your time isn’t too valuable elsewhere:

- You’re in the early stages of business

- You can’t yet afford outsourcing

- You’re not turning down revenue-generating work to do bookkeeping

You May Also Like: How to Choose Right Accountant for Your Business

When Professional Bookkeeping Makes More Sense

For many businesses, professional bookkeeping quickly becomes the better option.

You Should Consider Professional Help If:

1. Your business is growing or complex:

- High transaction volume (200+ per month)

- Multiple income streams

- Inventory or stock management

- Multiple bank accounts or currencies

- VAT registered with complex schemes

- Employee payroll

- Construction Industry Scheme (CIS)

2. You lack bookkeeping knowledge:

- You’re confused by debits, credits, and accounting principles

- You don’t know what’s tax-deductible

- You struggle to categorize transactions correctly

- You’ve made errors that created problems

3. Your time is valuable:

- You bill £30+ per hour in your business

- Every hour on bookkeeping is an hour not earning

- You have revenue-generating opportunities you’re missing

- Your expertise is in your trade, not administration

4. You’re consistently behind:

- Your records are always months out of date

- You dread bookkeeping and avoid it

- You spend weekends catching up

- Tax return season is nightmare chaos

5. You’ve made costly mistakes:

- You’ve missed VAT deadlines or made errors

- You’ve paid penalties for incorrect records

- You couldn’t make business decisions due to lack of financial clarity

- Your accountant has complained about your record quality

Conclusion

Can you do your own bookkeeping? Absolutely. With modern software, some basic knowledge, and consistent effort, many business owners successfully manage their own books.

Should you do your own bookkeeping? It depends. If your business is simple, you have the time and inclination, and the numbers make sense, DIY can work beautifully. But if your business is growing, your time is valuable, or you’re consistently struggling, professional bookkeeping isn’t an expense—it’s an investment that pays for itself in time saved, errors avoided, and better business decisions.

The key is being honest with yourself about your situation, capabilities, and priorities. Many successful business owners do their bookkeeping initially but transition to professional help as they grow. There’s no shame in either approach—only in letting your books fall into chaos because you chose wrong.

How Flux Accounting & Taxation Can Help?

We offer comprehensive bookkeeping services for businesses that have outgrown DIY or simply want professional support from day one. Our clients save time, avoid errors, have clear financial visibility, and can focus on growing their business rather than admin.

Not sure if you need us? Book a free consultation where we’ll honestly assess your situation and tell you whether DIY makes sense or professional help would serve you better. No pressure, no sales pitch—just honest advice.